It is the number one question my clients ask as the markets fluctuate and interest rates rise. Everyone wants to know if the housing market will further decline and are we heading to a “crash.” Let me share with you a few reasons as to why I believe the San Diego housing market will not “crash,” and in fact, it is an excellent time for Buyers to purchase a home for personal or investment purposes.

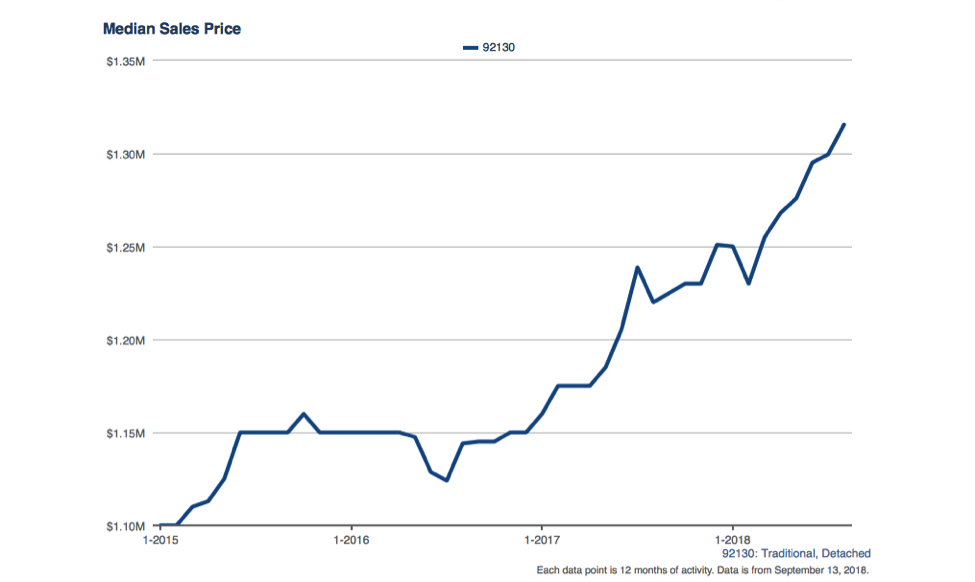

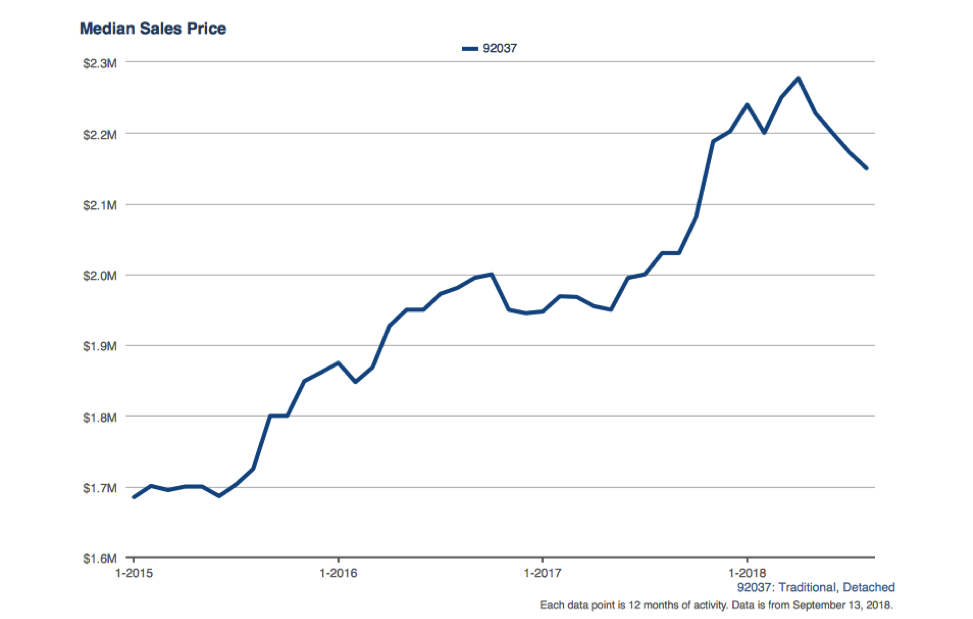

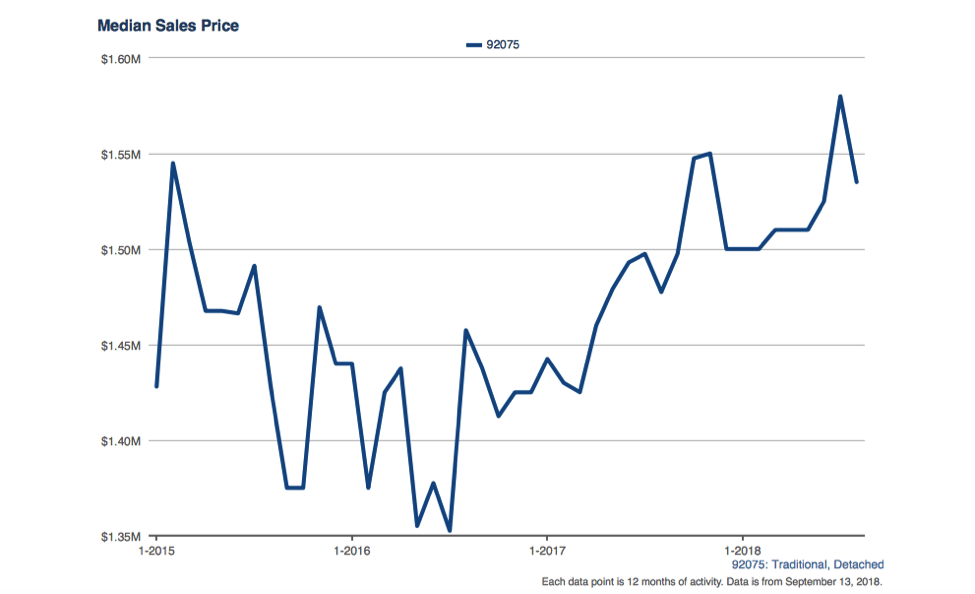

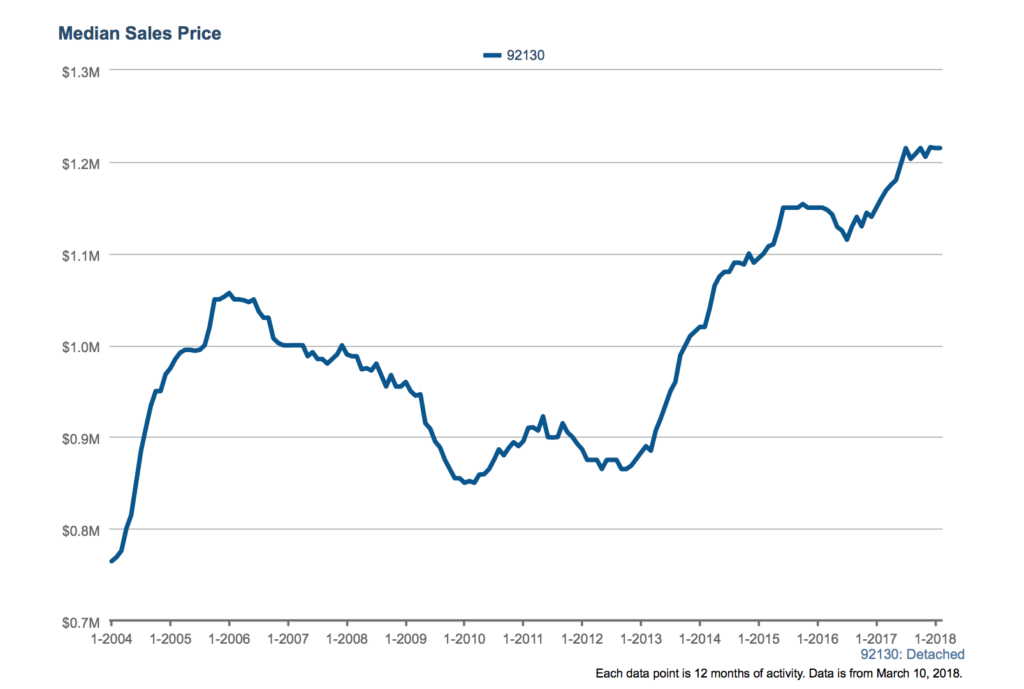

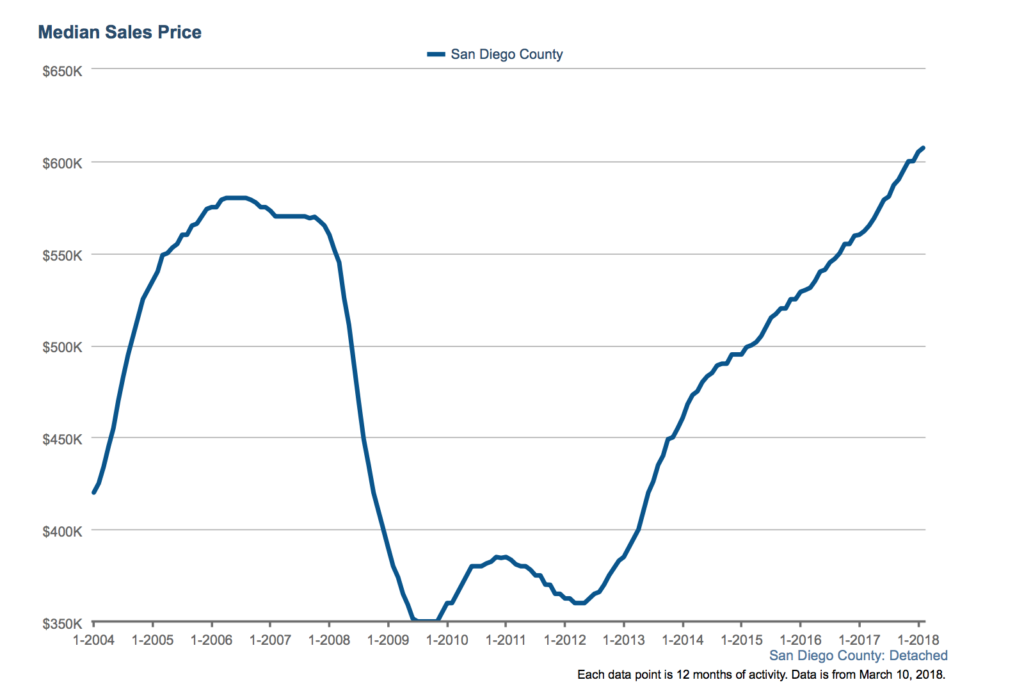

1. The Facts – In 2021, the San Diego real estate market appreciated up to 40%. We’ve seen a pricing decline of 10-15% in the last few months. The net result is that most homeowners still have substantial equity in their homes. Because of this equity, we do not see short sales or foreclosures. And Sellers aren’t “desperate.” The decline of the last few months is a market correction to adjust for the 2021 accelerated appreciation.

2. Historically Low Inventory – There is still a housing shortage in San Diego County, and it’s projected to take up to ten years to correct. Yes, more houses are on the market than last year. However, it’s still limited in many desirable communities.

3. Interest Rates – Interest rates are on the rise, but don’t make the mistake of thinking they will drop back to the historically low rates of 2021. Rates of 5%-6% are still fantastic, and they should not deter Buyers from making a purchase. If rates unexpectedly decline, the option to refinance is available.

4. Less Competition – Most homes today are sold without multiple offers. Take advantage of this competitive edge, and be the sole bidder. You most likely will get a discount off the list price, in addition to favorable terms that disappeared in the past year.

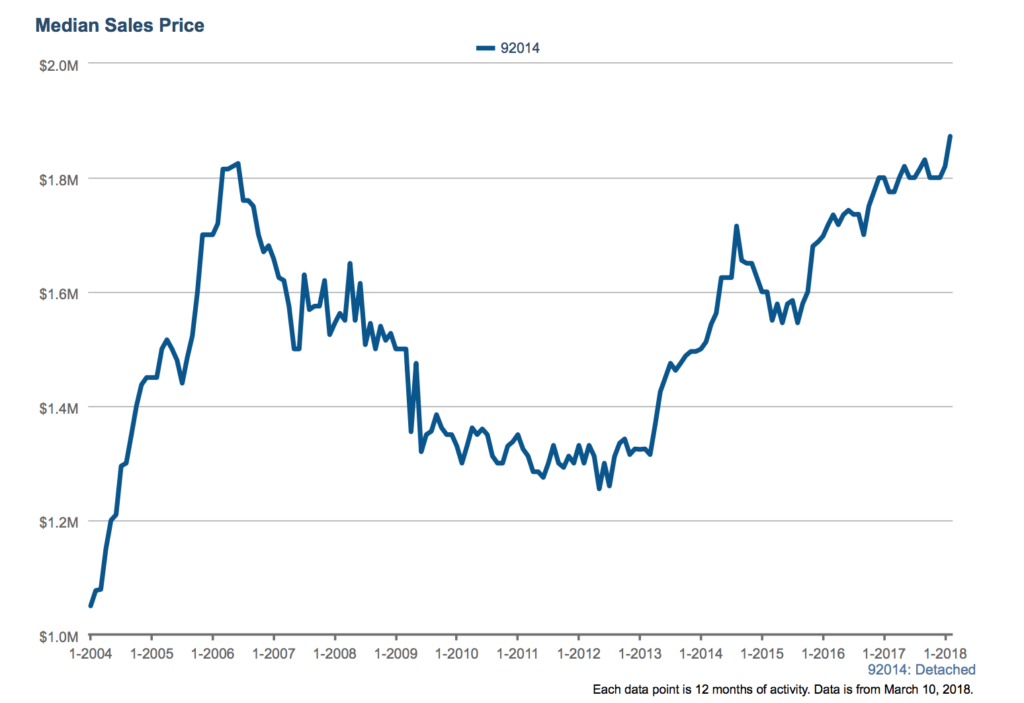

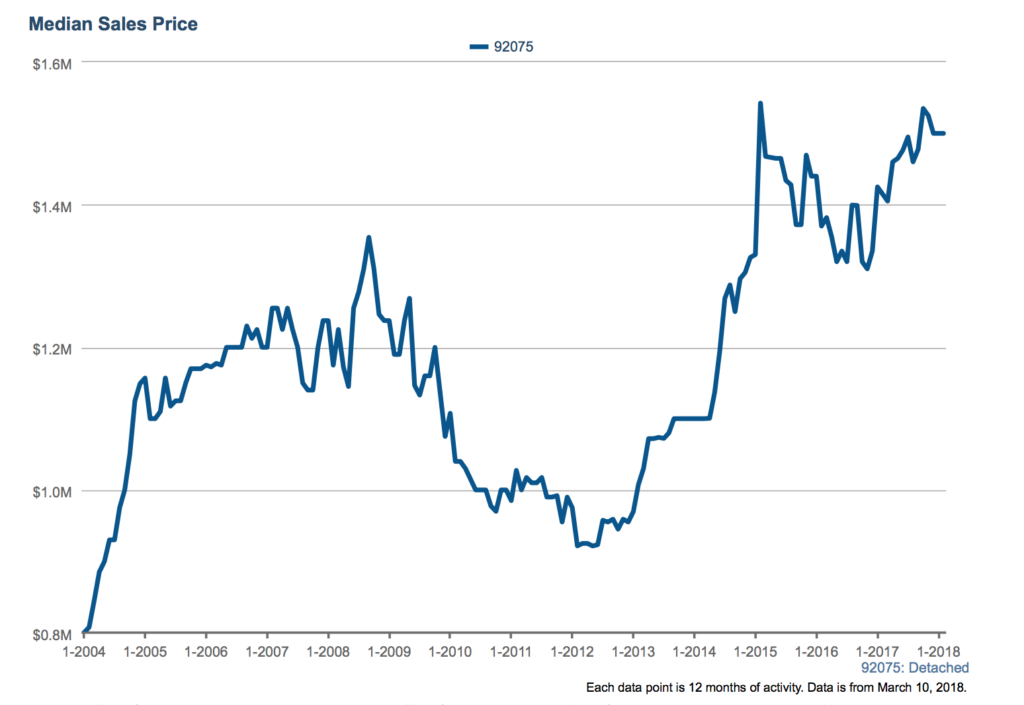

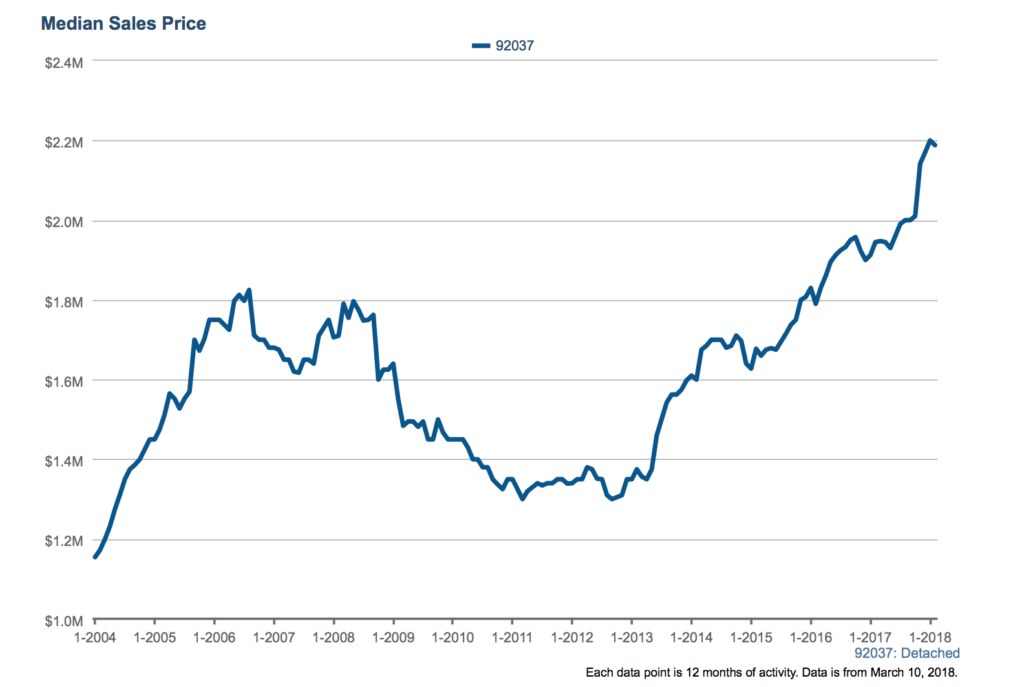

5. Safe Place to Hold Cash in Volatile Markets – Buying property is an excellent cash investment due to the stability of the real estate market in San Diego. Our market appreciates year after year and often outperforms other opportunities.

Have more questions about how the San Diego real estate market looks in your neighborhood or zip code? Give me a call!