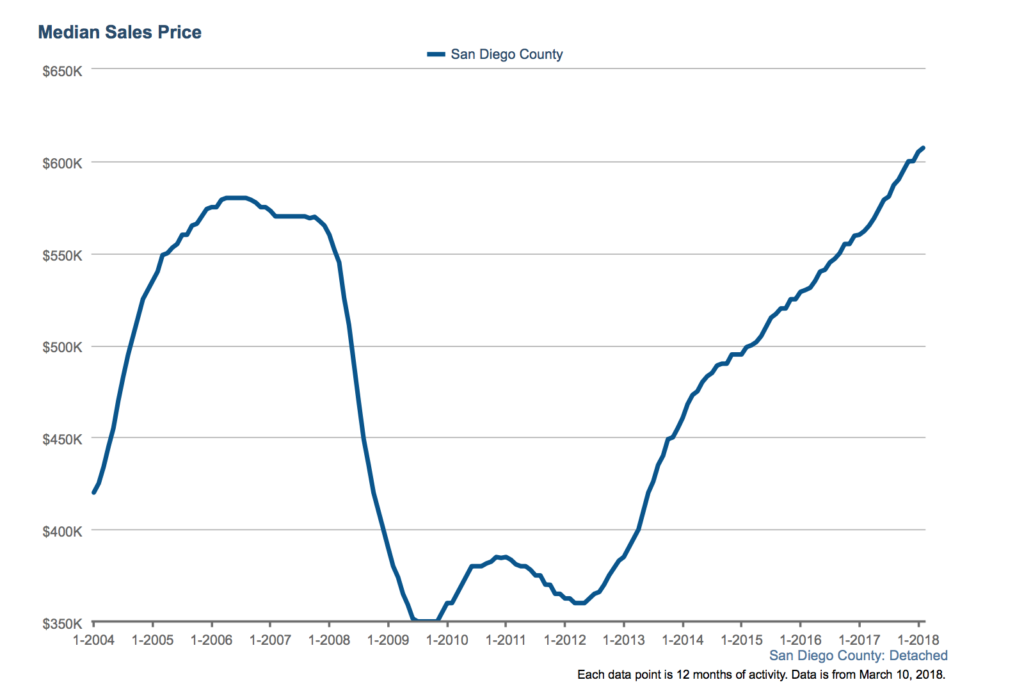

If you’ve been thinking about selling your home and either downsizing or purchasing something else, now is a great time to do it! Market indicators are showing that the San Diego housing market is peaking and we are heading for a downturn or softening. Home values can’t continue to rise indefinitely so if you’ve been waiting for the moment to list your home, this is it!

Just take a look at these numbers:

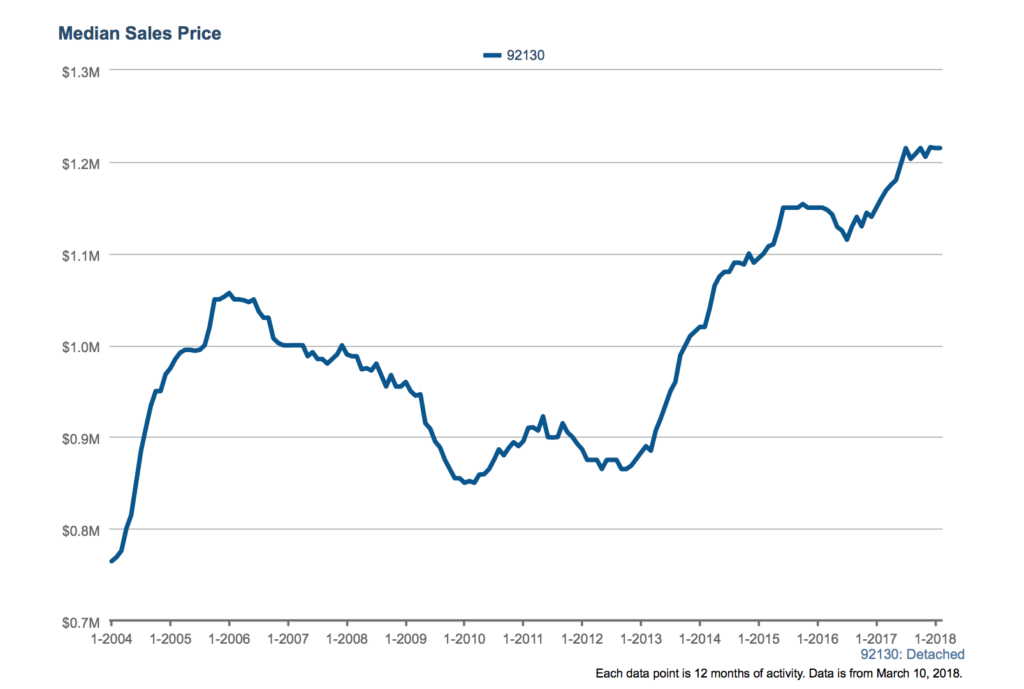

* Home prices in Carmel Valley have reached a fourteen-year high. The median price for a detached home is now $1,215,000.

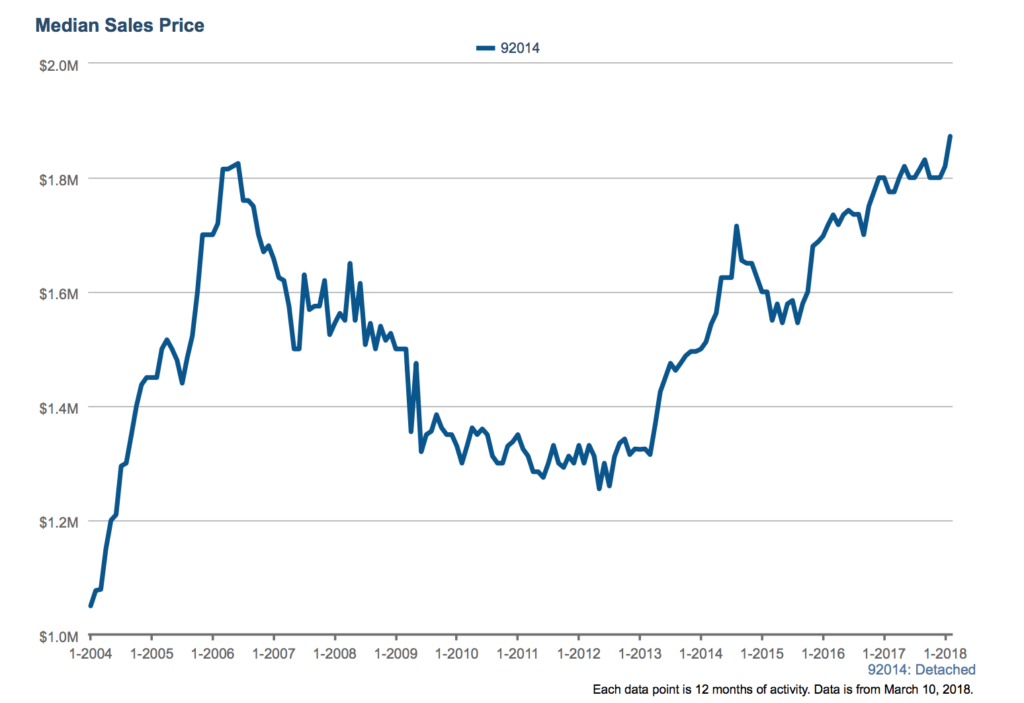

* In Del Mar, median home prices go up and down depending on the individual homes that have sold. But prices have been lingering around the pre-recession peak for many months now.

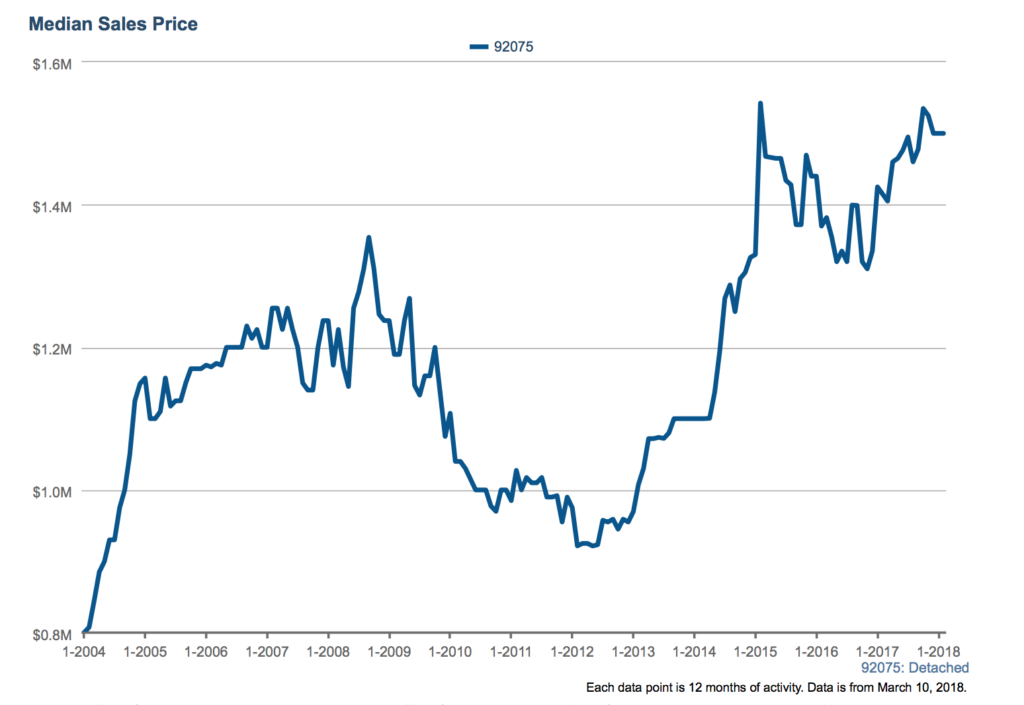

* Home values in Solana Beach are up 6% from last spring.

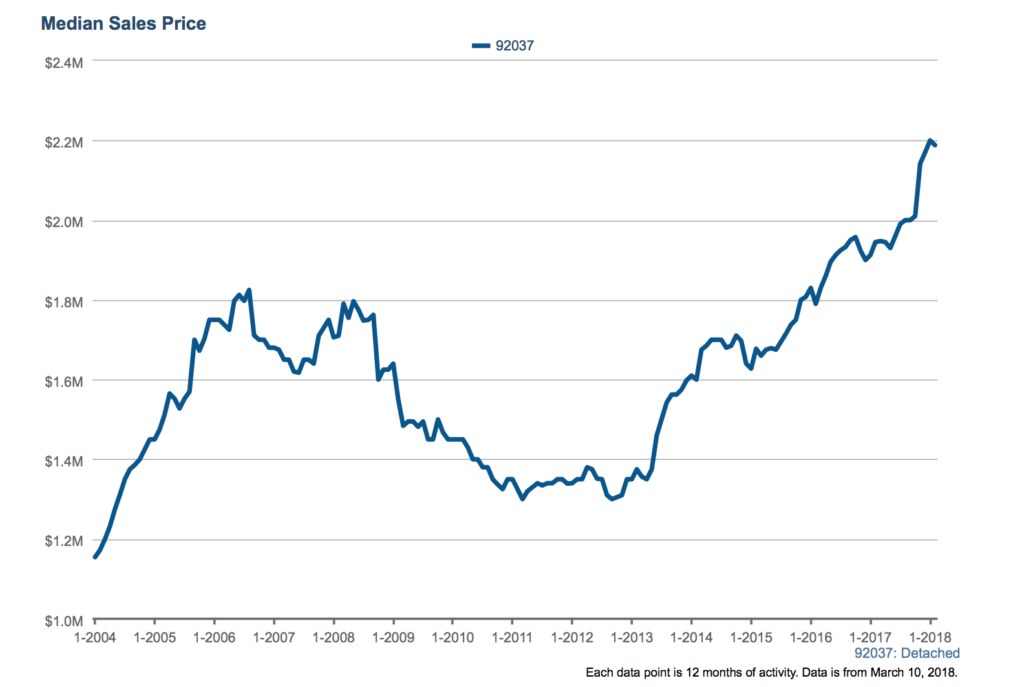

* In La Jolla, home prices have far surpassed their pre-recession peak and continue to rise month-over-month. In February, the median price for a detached home was $2.2 million dollars.

* And across the county, home prices are up 8.1% from last year at this time. The median home price is now $607,765, the highest it has been in fourteen years!

Curious to know what your home is currently worth? Want to know the best way to capitalize on this seller’s market AND get into a new home? Give me a call, I’d love to set up a time to discuss your unique situation!

[All data sourced from Sandicor MLS on March 10th, 2018]